Arkansas Transmission 101

Powering America: Why Transmission Lines Matter

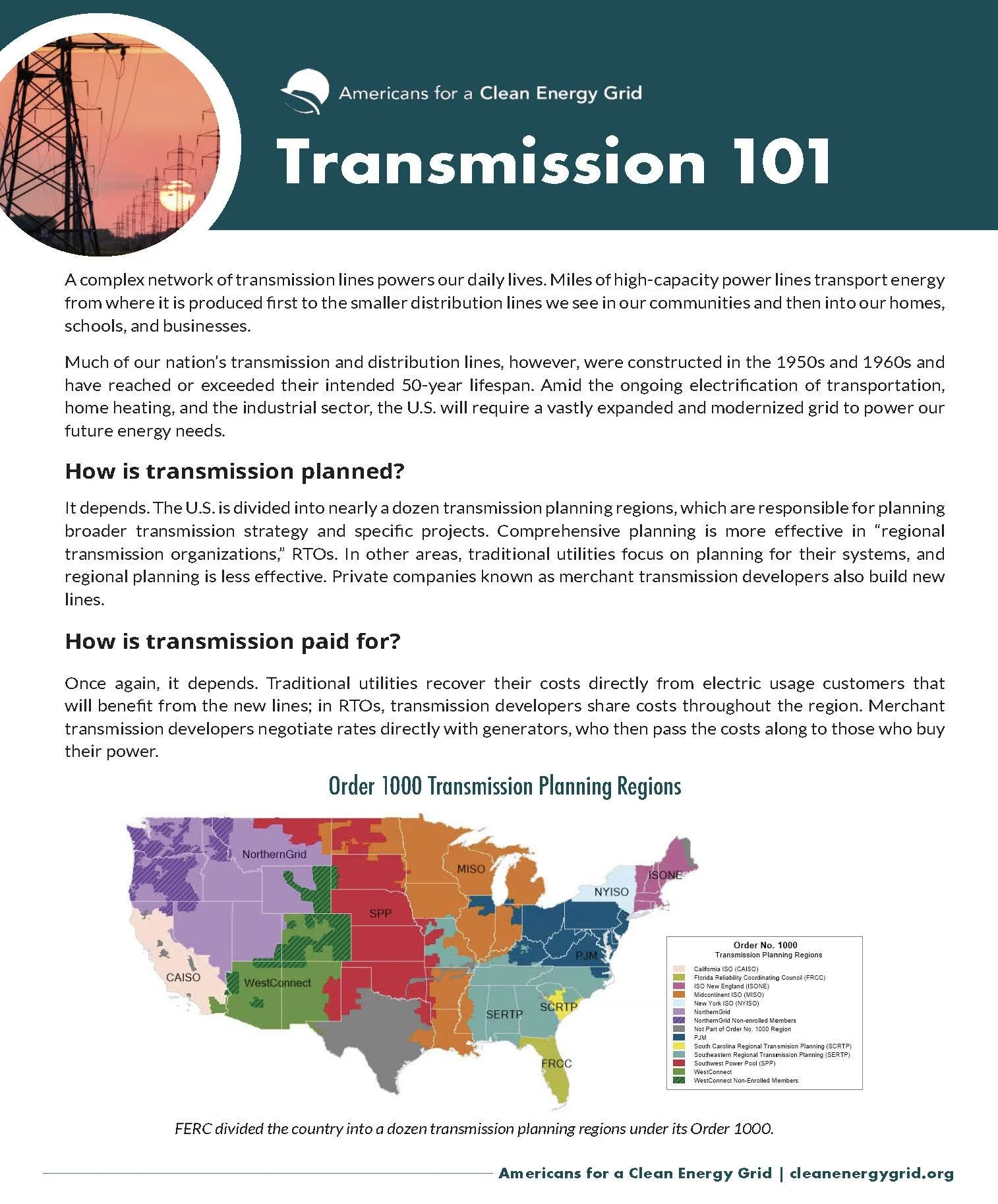

Transmission lines form the backbone of the U.S. electric grid, carrying high‑voltage energy over long distances—from generation sites (like solar farms, wind farms, or traditional power plants) to substations that serve homes, schools, hospitals, and businesses. As electricity demand grows and shifts toward renewable generation in remote areas, robust transmission becomes a strategic imperative. Multiple entities—local utilities, state agencies, federal regulators, and Regional Transmission Organizations (RTOs)—coordinate to plan and approve new transmission projects. This multi‑layered process determines where new lines should go, who pays for them, and how to align them with reliability, economic, and environmental goals.

Source: Americans for a Clean Energy Grid

The Benefits of Better Grid Infrastructure

Cleaner, cheaper electricity

Expanded transmission unlocks connections from large-scale wind and solar resources—lower‑cost sources that cut consumer bills and reduce carbon emissions [1][3].

Greater reliability

By enabling regions to share power reserves, a stronger grid resists outages from extreme weather or sudden generation loss—which disproportionately affect marginalized communities [4].

Supports the clean energy transition

Thousands of clean energy projects are currently waiting to connect to the grid, but capacity constraints slow progress. Expanding transmission is essential for reaching national decarbonization targets [5].

Transmission Challenges in the U.S.

Outdated infrastructure. About 70% of U.S. transmission lines are more than 25 years old—many components date back to the 1960s, increasing risks and reducing performance [6].

Slow growth. Transmission build‑out has slowed sharply: 3,000+ miles built annually before 2013, dropping to just 250 miles in 2022–23. Permitting delays and regulatory complexity are key bottlenecks [5][6][2].

Fragmented oversight. Complex jurisdiction across numerous agencies and resistance at state/local levels—local interests can veto projects that don’t serve their immediate constituency—create widespread barriers [7].

Policy Updates

FERC (2024): New rules encourage clustering and streamlined approval of well‑studied, ready‑to‑build interconnection projects. Introduces firm deadlines and financial penalties to accelerate interconnection studies and grid integration [8].

BIG WIRES Act (Congress, 2023–25): Proposes requiring each FERC region to have interregional transfer capacity equal to 30% of peak demand. Encourages shared upgrades, grid-enhancing technologies (e.g. dynamic line ratings), and demand-response strategies [9].

Department of Energy action: Federal permitting authority, backed by the Energy Policy Act of 2005, is increasingly used to override state blockages in critical corridors, supported by new investments in major transmission projects [8].

What’s Next: The Road Ahead

The Department of Energy’s “National Transmission Needs Study (2023)” projects that transmission capacity must increase 2.4–3.5 times by 2050 to support a clean-energy grid—delivering potential cost savings of $270 – $490 billion [10].

Analysts estimate “200,000+ miles of new high-voltage lines” are needed by mid-century to hit climate goals—the U.S. is currently building under 2,000 miles per year [9].

Innovations like reconductoring (replacing existing lines with higher-capacity conductors) and grid-enhancing assets offer faster, lower‑cost alternatives to full new build-outs [11].

Building a modern, resilient transmission network is crucial not only for meeting clean energy goals but for national security, consumer savings, and reliability in an electrified future.

Sources

[1]: https://www.cleanenergygrid.org/portfolio/fact-sheet-transmission-101

[2]: https://www.reuters.com/business/energy/us-grid-investments-take-off-power-demand-hikes-2025-01-28/

[3]: https://cleanpower.org/facts/clean-energy-transmission/

[4]: https://cleanenergygrid.org/portfolio/transmission-reliability-aceg-factsheet/

[5]: https://www.businessinsider.com/modernize-us-electric-grid-what-it-will-take-2024-5

[6]: https://www.vox.com/climate/408654/energy-transition-trump-tariffs-economy-threats-climate

[7]: https://en.wikipedia.org/wiki/National_Interest_Electric_Transmission_Corridor

[8]: https://en.wikipedia.org/wiki/Federal_Energy_Regulatory_Commission

[9]: https://en.wikipedia.org/wiki/BIG_WIRES_Act

[10]: https://www.energy.gov/sites/default/files/2023-12/National%20Transmission%20Needs%20Study%20-%20Final_2023.12.1.pdf

[11]: https://en.wikipedia.org/wiki/Electric_power_transmission

Transmission in Arkansas

Limited Buildout: Arkansas has seen modest transmission development compared to its growing energy needs.

SPP Region: Arkansas is part of the Southwest Power Pool (SPP), which oversees regional transmission planning and operations. While SPP has improved grid coordination, additional buildout is needed to accommodate new generation and improve reliability.

Energy Transition Pressure: With coal retirements, new load growth, and renewable projects on the rise, transmission capacity is increasingly strained.

Recent Advancements in Arkansas

AEP’s Work on Renewable Integration: Utilities like SWEPCO (an AEP company) are beginning to invest in grid upgrades to better handle renewable generation.

SPP Seam Coordination: Arkansas stakeholders are engaging in conversations about how to better coordinate with MISO and other neighboring grid operators for interregional transmission planning.

Federal Momentum: Recent FERC and DOE initiatives may provide more funding and streamlined permitting that could benefit Arkansas transmission projects.

Stakeholder Advocacy: Groups like the Arkansas Advanced Energy Association are working to elevate the importance of transmission in regulatory and legislative conversations.

Bottom Line:

Arkansas’s transmission grid must evolve to meet growing demand, integrate renewables, and ensure long-term reliability. Strategic planning, interregional cooperation, and policy support will be key to unlocking the state’s full energy potential.